702-660-7000

702-660-7000

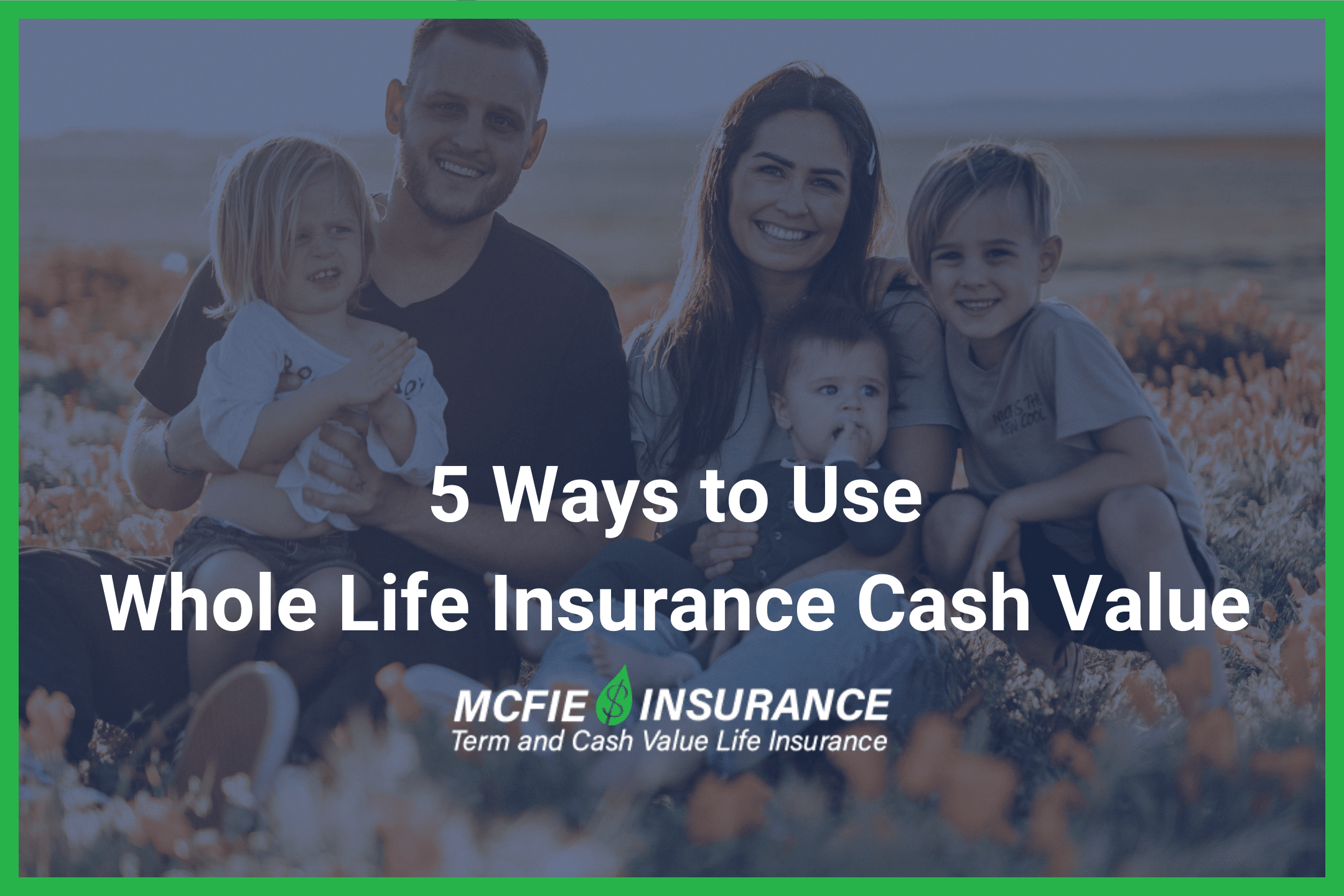

Life insurance stands as a cornerstone in safeguarding your family’s well-being, securing your financial future, and crafting a lasting legacy. Andrew Carnegie esteemed life insurance as the “fourth pillar of Americanism,” underscoring its foundational role. While many associate life insurance primarily with its death benefit, its impact stretches far beyond that, providing a safety net for families in times of profound loss. Death benefits have enabled continued education for children, helped families retain their homes, sustained businesses, and ensured food security, making those who plan ahead with life insurance true guardians of their families’ futures.

Beyond the immediate relief of death benefits, certain life insurance policies offer living benefits that can be accessed during the policyholder’s lifetime. These living benefits, such as those provided by McFie Insurance, become instrumental in managing college expenses, replacing income, and planning for retirement, making life insurance an invaluable tool in comprehensive financial planning.

When strategizing for financial goals with McFie Insurance, Participating Whole Life Insurance emerges as the premier choice due to its cash value feature, which accumulates over the insured’s lifetime. This cash value is readily accessible and can be utilized for various purposes at any time.

While Participating Whole Life insurance is renowned for its cash-value component, it’s not alone in this aspect. Whole Life, Universal Life, Variable Life, and Indexed Universal Life policies also incorporate cash-value elements. However, discerning the nuances among these policies is crucial, as the nature of cash value can vary significantly.

In Whole Life policies, both participating and traditional, the cash value acts as a portion of the death benefit you essentially own, known as Paid-Up insurance. The insurer makes this cash value accessible, allowing it to grow over time and thereby increasing the accessible amount.

In Universal Life policies, the cash value isn’t always linked to the death benefit, which often consists of Term insurance devoid of cash value. For Indexed and Variable Life policies, the cash value stems from surplus premium payments and the performance of either index-mirroring accounts or market returns. The insurer then deducts any policy-associated fees before adding value to the accumulated cash account, highlighting the importance of understanding these differences for informed financial planning.

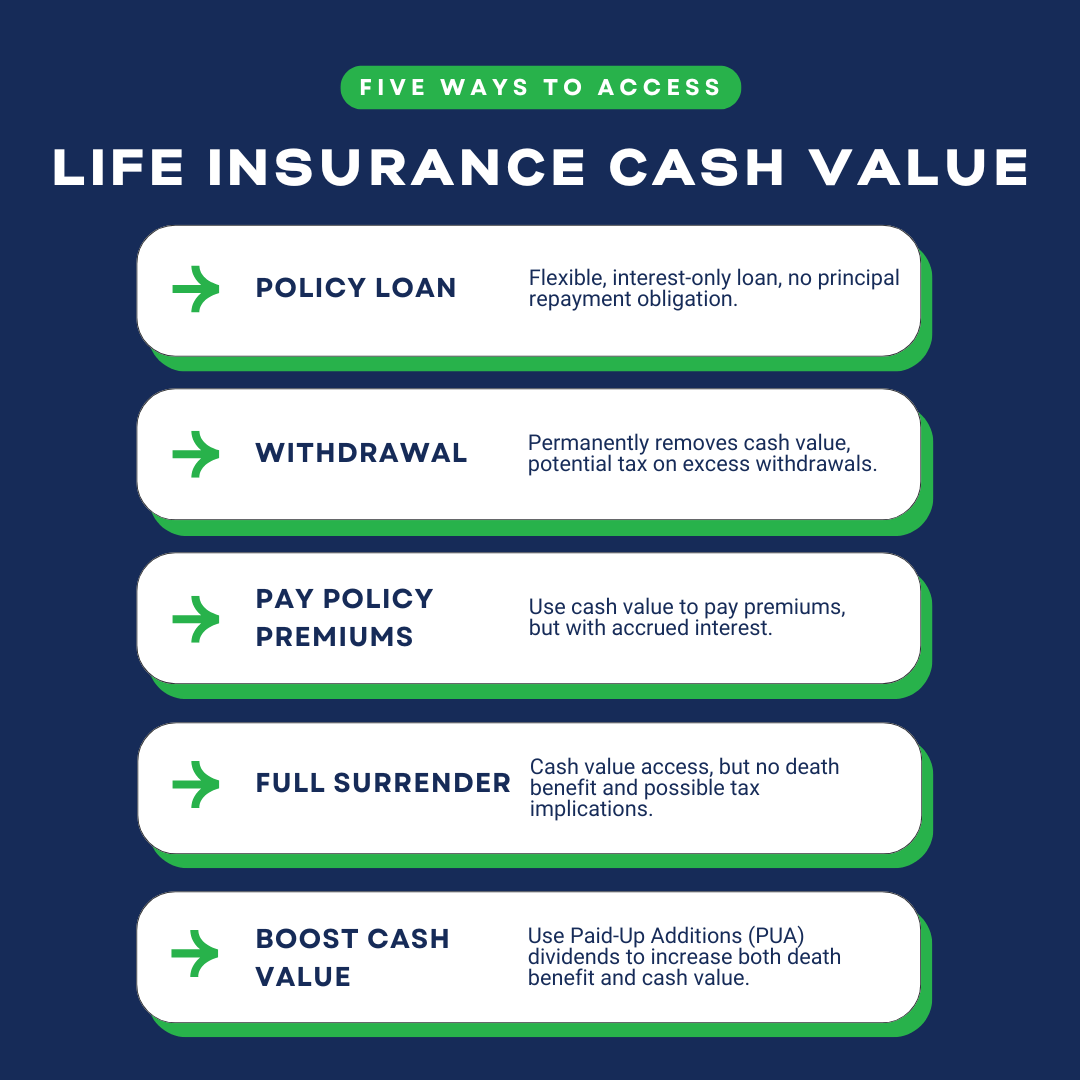

There are several things you can do with the cash-value of your life insurance policy during your lifetime. Listed here are five ways to access cash-value as well as an option for boosting the cash-value available to you.

#1 – Policy Loan

Your policy’s cash value is readily accessible through a policy loan, offering a flexible financial tool whenever you need it. This type of loan is structured on an interest-only basis, meaning there’s no obligation to repay the principal amount, only the interest. However, it’s crucial to note that loan interest rates are not uniform across all insurance companies and can fluctuate annually, based on the specific terms laid out in your policy contract. This variability emphasizes the importance of understanding your policy’s details to make informed decisions about leveraging your policy’s cash value,

#2 – Withdrawal

Additionally, you can opt to withdraw cash value from your life insurance policy instead of taking a policy loan. Before proceeding with such a withdrawal from a Whole Life policy, it’s essential to grasp the implications fully.

A withdrawal equates to a partial surrender of your policy, meaning you’re choosing to take cash value directly rather than borrowing against it. Remember, withdrawals are irreversible; once you’ve taken out cash value, there’s no option to redeposit it, unlike repaying a loan. Moreover, the size of your withdrawal could potentially lead to tax consequences.

When you withdraw funds from your whole life insurance, you’re essentially surrendering a portion of your Paid-Up insurance, which corresponds to a segment of your death benefit, proportional to the cash value withdrawn.

Understanding the cost basis of your policy is crucial in this context. The cost basis represents the sum of premiums you’ve paid into the policy over time. Life insurance policies enjoy tax-deferred growth, meaning that withdrawing an amount beyond your cost basis will lead to taxable income.

Taxes are applied to any amount withdrawn that exceeds the cost basis. It’s important to note that taxes are only incurred on funds permanently removed from the policy, through either withdrawal or complete surrender. In contrast, policy loans are not subject to taxation, offering a non-taxable avenue to access your policy’s cash value.

#3 Pay policy premiums

You have the option to utilize the cash value of your policy to cover due premiums, a method frequently employed through an internal policy loan. This process mirrors that of obtaining a regular policy loan, with the distinction that the insurance company doesn’t disburse the loan amount directly to you. Instead, they allocate the borrowed funds to settle your policy’s premiums. It’s important to note, however, that this loan will accrue interest similarly to any other policy loan. Consequently, relying on policy loans to finance your premiums is not advisable as a sustainable strategy for long-term policy funding.

#4 Full Surrender

Accessing your policy’s cash value is also possible through a full surrender, which is akin to making a withdrawal. However, a full surrender might lead to tax implications if the policy’s surrender value surpasses the cost basis, just as with withdrawals. It’s crucial to remember that any form of surrender, whether partial or full, is irrevocable. Opting for a full surrender means you will relinquish the policy’s death benefit entirely.

#5 Boost Cash-value and Death Benefit

Enhancing the cash value and death benefit of your life insurance policy can effectively be achieved through dividends, particularly if you’re opting for a Participating Whole Life insurance policy. One of the most advantageous options for this purpose is the “PUA” (Paid-Up Additions) dividend option. This choice directs your dividends towards purchasing additional Paid-Up insurance, thus expanding your policy’s death benefit and concurrently increasing the accessible cash value, as the latter is directly linked to the amount of Paid-Up insurance in a whole life policy. It’s important to note, however, that this beneficial option is exclusive to Participating Whole Life policies.

A common question pertains to the what happens to a whole life policy’s cash value upon the insured’s death. It’s essential to understand that the cash value is a component of the overall death benefit, representing the portion of Paid-Up Insurance owned. Upon the insured’s passing, the beneficiary receives the entire death benefit, including the value attributed to Paid-Up Insurance, leaving no remaining cash value within the policy.

Understanding the Infinite Banking Concept and How It Works In Our Modern Environment 31-page eBook from McFie Insurance Order here>

Life insurance is often acquired with the future in mind, yet unforeseen circumstances—such as an increase in premiums, income loss, or sudden expenses—can challenge one’s ability to uphold the originally intended policy. Nevertheless, various strategies exist to lessen or even waive the premium payments while preserving the essential coverage and advantages your policy offers. These alternatives provide flexibility and support, ensuring that your protective measures remain intact despite life’s unpredictable turns.

|

Policy Checklist Make Sure You Get a Good Policy Is your policy good or bad? Use this checklist to help evaluate your existing life insurance or a new policy you are considering. |

Here are three ways you can reduce and eliminate premiums or combat a rising premium on a life insurance policy.

#1 – Reduced Paid-Up

Choosing a Reduced Paid-Up option for your life insurance policy can provide financial relief by eliminating future premium payments. When you select this option, the insurance company waives all upcoming premiums, effectively altering the policy’s terms. Consequently, the death benefit is adjusted downwards to align with the policy’s Paid-Up Insurance value, which then remains fixed, exempt from further premium requirements. While this adjustment decelerates the policy’s growth potential, dividends can still contribute to a gradual increase in the death benefit over time, offering a balanced approach to maintaining coverage without the financial strain of continued premiums.

#2 – Dividends to pay premium

If you hold a Participating Whole Life insurance policy, there’s an option to allocate dividends towards your premium payments. It’s important to remember, however, that dividends are not guaranteed until they are actually distributed, and they tend to be relatively modest in the initial years of the policy. While it’s not advisable to purchase a policy solely with the expectation that dividends will cover the premiums, they can indeed contribute to premium payments, either partially or in full, as they accrue. This can offer some relief in managing the annual premium costs associated with maintaining your policy.

#3 – 1035 exchange

If you notice your life insurance premiums escalating each year, it’s probable you’re dealing with a Term policy or a certain type of Universal Life policy. For Term insurance with rising premiums, consider replacing it with a new Term policy featuring a fixed premium period, or switch to a permanent life insurance with a stable premium. This is a viable option if you’re in good health and younger than 80.

For those with a Universal Life policy facing increasing premiums, an option exists to exchange it for a Whole Life policy that guarantees level premiums. This swap, known as a 1035 Exchange, allows for the transition from one Permanent life insurance policy to another, contingent on insurability. Upon approval of the new policy, the value of your existing policy can be transferred to the new one, ensuring continuity and stability.

The realm of life insurance is filled with specific jargon and concepts, all pivotal to understanding the structure and functionality of your policy. At McFie Insurance, we strive to demystify life insurance, ensuring you don’t need to master a new lexicon to enjoy its benefits for you and your family.

Should you have any inquiries or require assistance in understanding life insurance nuances, we’re here to support you. Whether you’re looking to secure a policy that safeguards your family’s future or seeking clarity on your current coverage, we’re ready to help. We invite you to schedule a complimentary consultation to explore the most suitable insurance solutions for you and your loved ones.

by Gracine McFie

by Gracine McFie

There are many ways to access information about finances, but it can be hard to determine which sources are trustworthy. I like to put information together in an accurate, straightforward, easy to understand manner so people can make good financial decisions based on the information provided without having to waste time wondering if the source is reliable.