702-660-7000

702-660-7000

A new set of statistics has recently emerged, shedding light on the current state of 401(k) balances across the United States. At first glance, the numbers might appear encouraging. According to Vanguard, the average balance for defined contribution plans—most of which are 401(k)s—climbed to $134,128 in 2023. This represents a notable 19% increase from the end of 2022. While this uptick may initially seem like a financial win for retirement savers, it’s worth pausing before drawing conclusions. A closer look is needed to understand what these numbers mean and whether they reflect genuine progress for the average American worker.

Relying solely on averages can paint a misleading picture. Average figures are often distorted by outliers—those few individuals who have amassed exceptionally large 401(k) balances, sometimes reaching into the seven-figure range. While it’s true that these high-saving individuals do exist, they are far from typical. Most Americans aren’t sitting on million-dollar retirement accounts. To better understand the financial reality facing the majority of workers, it’s far more helpful to examine median balances. The median provides a clearer, more accurate snapshot of where most people actually stand when it comes to saving for retirement.

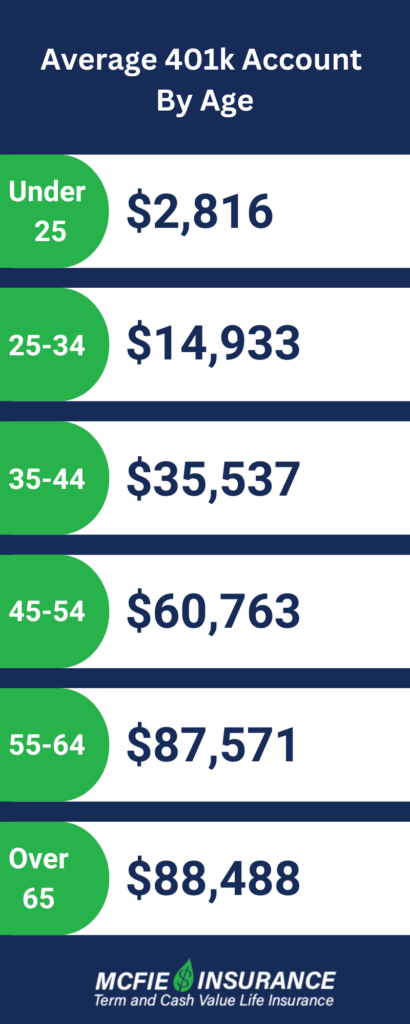

When we examine the median 401(k) balances by age group, a sobering truth emerges:

Under 25: $2,816

25 to 34: $14,933

35 to 44: $35,537

45 to 54: $60,763

55 to 64: $87,571

65 and older: $88,488

These figures offer a stark contrast to the seemingly optimistic average of $134,128. In reality, they show that half of all 401(k) participants have saved less—often significantly less—than that amount for retirement. This gap between the average and the median underscores the importance of not taking headline numbers at face value.

That said, it’s important to keep these numbers in perspective. They show only one aspect of the broader retirement savings landscape. Many individuals may also be putting money away in other types of accounts, like Individual Retirement Accounts (IRAs), taxable brokerage accounts, or through investments in assets like real estate. These savings can help supplement what’s in a 401(k) and offer a more complete financial picture.

Still, it’s worth noting that for a large portion of the American workforce, the 401(k) isn’t just one piece of the puzzle—it’s often the centerpiece, and in many cases, the only piece. This heavy dependence on employer-sponsored retirement plans is troubling. While 401(k)s can be an effective tool for building long-term wealth, they were never meant to carry the full burden of retirement on their own. Relying on them as the sole strategy can leave workers vulnerable, especially if they’re not saving enough or if market conditions take a turn for the worse. A more diversified and intentional approach to retirement planning is essential for long-term financial security.

So why have 401(k)s become so dominant in the retirement landscape? The answer lies partly in their convenience. These plans are often automatically set up by employers, with contributions deducted directly from paychecks. Many companies also offer matching contributions, which can feel like “free money” to employees. Furthermore, the tax advantages of 401(k)s – particularly the ability to contribute pre-tax dollars – make them an attractive option for reducing current tax burdens.

However, this convenience and these immediate benefits can blind us to some of the limitations and potential drawbacks of relying too heavily on 401(k)s. Let’s explore a few reasons why diversifying beyond your 401(k) might be a wise move:

1. Limited Investment Options

Most 401(k) plans offer a restricted menu of investment choices, typically consisting of a handful of mutual funds. While this simplifies decision-making for participants, it also limits their ability to tailor their portfolio to their specific needs and risk tolerance. By exploring options outside of your 401(k), you can access a wider range of investments, including individual stocks, bonds, real estate investment trusts (REITs), and more.

2. Lack of Flexibility

401(k)s are designed for long-term saving, with strict rules governing when and how you can access your money. While this can be beneficial in preventing early withdrawals, it can also be problematic if you need to access funds before retirement age. Other investment vehicles, such as taxable brokerage accounts, offer more flexibility in terms of withdrawals.

3. Potential for High Fees

Many 401(k) plans come with administrative fees and expense ratios that can eat into your returns over time. While some plans offer low-cost options, others may saddle participants with high-fee funds that underperform the market. By investing outside of your 401(k), you have more control over the fees you pay.

4. Tax Considerations

While the ability to contribute pre-tax dollars to a traditional 401(k) can provide immediate tax benefits, it also means you’ll owe taxes on withdrawals in retirement. Depending on your tax situation in retirement, this could result in a higher tax burden than you anticipated. Diversifying with after-tax investment options, such as Roth IRAs or taxable accounts, can provide more tax flexibility in retirement.

5. Limited Control

With a 401(k), your investment options are largely determined by your employer and the plan administrator. You have little say in which funds are offered or how the plan is managed. By investing outside of your 401(k), you can take a more active role in managing your retirement savings.

So, what alternatives should we consider alongside our 401(k)s? Here are a few options to explore:

1. Individual Retirement Accounts (IRAs)

Both traditional and Roth IRAs offer tax advantages and a wider range of investment options than most 401(k)s. A Roth IRA, in particular, can be an excellent complement to a traditional 401(k), as it provides tax diversity in retirement.

2. Taxable Brokerage Accounts

While these accounts don’t offer the same tax advantages as retirement accounts, they provide maximum flexibility in terms of investment choices and withdrawals. They can be an excellent option for goals that may occur before retirement age.

3. Real Estate Investments

Whether through direct property ownership or REITs, real estate can provide diversification and potential income streams that aren’t correlated with the stock market.

4. Health Savings Accounts (HSAs)

If you’re eligible, an HSA can serve as a powerful retirement savings tool. Contributions are tax-deductible, grow tax-free, and can be withdrawn tax-free for qualified medical expenses. After age 65, you can withdraw funds for any purpose without penalty (though non-medical withdrawals will be taxed as income).

5. Small Business Retirement Plans

For self-employed individuals or small business owners, options like SEP IRAs or Solo 401(k)s can offer higher contribution limits and more control than traditional employer-sponsored plans.

As we begin to consider alternatives to the traditional 401(k), it’s worth taking a closer look at a financial tool that has quietly supported families and individuals for generations: whole life insurance. Though it’s often overshadowed in today’s financial planning conversations, whole life insurance brings a set of advantages that can serve as a complement to more conventional retirement savings strategies.

At its foundation, whole life insurance provides a guaranteed death benefit to your beneficiaries, guaranteeing a measure of financial stability and peace of mind for your loved ones after you’re gone. But the true value of whole life insurance reaches beyond this basic protection. Unlike term life insurance, which is designed to provide coverage for a limited period and then expires, whole life insurance builds cash value steadily over time. This growing cash value can be accessed while you’re still alive, making it a living financial asset that offers flexibility, liquidity, and stability throughout your life.

For those looking to diversify their retirement approach or add a reliable, long-term component to their financial plan, whole life insurance deserves thoughtful consideration.

This cash value grows tax-deferred and can be accessed through policy loans without triggering taxable events. This feature provides a level of flexibility rarely found in other financial instruments. Whether you need funds for a major purchase, want to supplement your retirement income, or face unexpected expenses, your whole life insurance policy can serve as a readily available source of liquidity.

The growth of cash value in a well-designed whole life policy is guaranteed, offering a level of certainty that can be comforting in an uncertain financial landscape. This guaranteed growth occurs independently of market fluctuations, providing a stable counterbalance to more volatile investments in your portfolio.

Many whole life insurance policies also offer the potential for dividends. While not guaranteed, dividends from mutual insurance companies have historically provided policyholders with additional value, further boosting the policy’s cash value or providing a source of income.

For business owners, whole life insurance can be a valuable tool for succession planning, key person insurance, or funding buy-sell agreements. The flexibility and tax advantages of these policies make them adaptable to various business needs.

It’s important to note that not all whole life insurance policies are created equal. The benefits you receive depend greatly on how the policy is structured. Working with a knowledgeable professional who can design a policy tailored to your specific needs and financial goals is crucial.

While whole life insurance shouldn’t be viewed as a replacement for other retirement savings vehicles, it can serve as a powerful complement to your overall financial strategy. Its unique combination of guaranteed growth, tax advantages, and lifetime coverage makes it worth considering as part of a diversified approach to long-term financial planning.

As we reflect on the latest 401(k) balance figures, let’s resist the temptation to judge our financial health solely by these metrics. Instead, let’s broaden our perspective and consider a more holistic approach to retirement planning. By diversifying our savings and investment strategies, we can build a more resilient and personalized financial future.

Remember, the path to a secure retirement isn’t about blindly following averages or relying on a single savings vehicle. It’s about understanding our unique needs, goals, and circumstances, and crafting a strategy that aligns with our individual vision for the future. While 401(k)s can certainly play a role in this strategy, they shouldn’t be the only tool in our retirement planning toolbox.

As we navigate the complex world of personal finance, let’s strive to educate ourselves, seek out diverse perspectives, and make informed decisions that serve our long-term interests. By taking a more active and comprehensive approach to our financial planning, we can work towards a retirement that’s not just financially secure, but truly fulfilling.

In the end, our financial future is too important to leave to chance or to entrust entirely to a single savings vehicle. Let’s take control of our destiny, explore all our options, and build a retirement strategy that’s as unique and multifaceted as we are. After all, isn’t that what true financial independence is all about?

by Gracine McFie

by Gracine McFie

There are many ways to access information about finances, but it can be hard to determine which sources are trustworthy. I like to put information together in an accurate, straightforward, easy to understand manner so people can make good financial decisions based on the information provided without having to waste time wondering if the source is reliable.