702-660-7000

702-660-7000

When it comes to securing your financial future, the number of options can be overwhelming. Two strategies that often surface in these conversations are 401(a) retirement plans and whole life insurance. After years of helping individuals protect their wealth, grow their assets, and build lasting financial confidence, I’ve seen firsthand how each of these tools works—and where they fall short. In this breakdown, I’ll explain what 401(a) plans are, how they function, and why I believe whole life insurance often provides a more flexible and powerful path to long-term financial security for many people. Let’s dive into what 401(a) plans are all about and why I believe whole life insurance is often a better choice for many people.

Let’s start with the basics—what exactly is a 401(a) plan? A 401(a) is an employer-sponsored retirement plan commonly offered by government entities, schools, and certain non-profit organizations. While it shares some similarities with the more familiar 401(k), there are important differences that set it apart.

With a 401(a), both the employer and employee can contribute, but it’s the employer who determines the contribution structure, eligibility rules, and vesting schedule. When it’s time to access the funds, you typically have three options: roll the balance into another qualified retirement account, take a lump-sum distribution, or convert the funds into an annuity.

At first glance, a 401(a) might seem like a solid, reliable way to save for retirement. But once you look under the hood, you’ll find some limitations that could impact your financial flexibility and long-term goals. Let’s take a closer look at how these plans work in practice—and why they may not be the best fit for everyone.

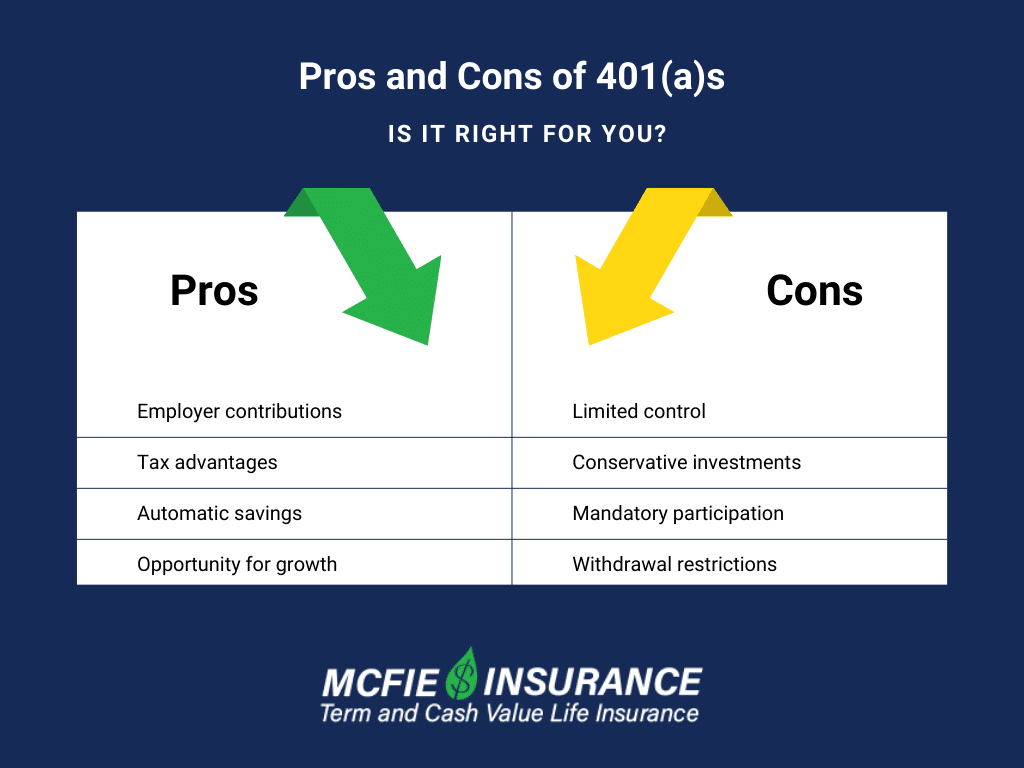

Like any financial product, 401(a) plans have their upsides and downsides.

Now, let’s talk about an alternative that I believe offers more benefits and flexibility: whole life insurance. I know what you’re thinking – isn’t life insurance just about the death benefit? Not at all. A well-designed whole life insurance policy can be a powerful financial tool during your lifetime.

Here’s why I often recommend whole life insurance over 401(a) plans:

Now, don’t get me wrong—401(a) plans aren’t without merit. They can serve as a decent foundation for retirement savings, especially when your employer is making contributions on your behalf. But when it comes to building long-term financial security and maintaining control over your money, I believe whole life insurance stands out as the better option. Here’s why:

Control: With whole life insurance, you’re in charge. Unlike a 401(a), where you’re bound by your employer’s rules and retirement timelines, a whole life policy puts the decision-making power in your hands. You’re not at the mercy of market swings or someone else’s contribution schedule.

Flexibility: Life doesn’t always follow a straight path. Whether you need access to funds before retirement, want to adjust your premiums, or are navigating a life change, whole life insurance gives you the flexibility to adapt—something many retirement plans can’t match.

Guaranteed Growth: In a world full of economic uncertainty, the predictability of whole life insurance is a major advantage. It offers guaranteed cash value accumulation and a guaranteed death benefit—something most investment-based retirement accounts can’t promise.

Multiple Benefits: Whole life insurance is more than just a safety net—it’s a versatile financial tool. It can help you supplement retirement income, fund a child’s education, cover emergency expenses, or leave a legacy for your loved ones. Think of it as a financial Swiss Army knife.

Tax Advantages: One of the most overlooked benefits of whole life insurance is its tax treatment. Enjoy tax-deferred growth, potential tax-free access to your policy’s cash value, and a death benefit that passes on to your beneficiaries income tax-free.

While 401(a) plans may offer a starting point, whole life insurance provides a dynamic, long-term strategy for those who want more than just a retirement plan—they want a financial system that works for them, not against them.

Now, I know that some financial “gurus” will confidently tell you to “buy term and invest the difference.” On paper, that advice sounds simple enough. But in reality, most people don’t actually invest the difference. They spend it. And years down the line, they’re left with a term policy that’s expired or getting more expensive, and no accumulated savings or financial cushion to show for it.

That’s where a well-structured whole life insurance policy makes all the difference. It encourages disciplined saving by design. You’re building long-term value in the form of cash reserves you can access during your lifetime—whether it’s to seize an opportunity, cover an emergency, or supplement retirement—all while maintaining permanent protection for your loved ones.

Now, I’m not claiming whole life insurance is a one-size-fits-all solution. Your financial journey is personal. What’s right for your neighbor or coworker may not be right for you. And if your employer offers a 401(a) with a generous match? Take it. That’s free money, and it can play a solid role in your overall retirement picture.

But don’t stop there. Consider how a high-cash-value whole life insurance policy could complement your broader financial strategy—giving you greater control, liquidity, and certainty.

That’s exactly why we always begin with a strategy session at McFie Insurance. We take the time to get to know you—your goals, your current situation, and what matters most to you. Only then do we design a personalized plan that helps you protect what you’ve built, grow your wealth, and achieve lasting financial peace of mind.

At the end of the day, it’s not about choosing between a 401(a) or whole life insurance. It’s about building a financial system that empowers you to keep more of what you earn, prepare for the unexpected, and live with greater confidence in the future.

At the end of the day, whether you choose a 401(a) plan, whole life insurance, or a combination of both, what matters most is that you’re taking steps to secure your financial future. Don’t let anyone tell you there’s only one right way to do things. Your financial journey is yours alone.

If you’re intrigued by the potential of whole life insurance or just want to explore your options, I encourage you to reach out. At McFie Insurance, we’re passionate about educating people on how to make the most of their money. We’d be happy to sit down with you, answer your questions, and help you design a financial strategy that truly works for you.

Remember, it’s your money, your future, and your choice.

Tomas P. McFie DC PhD

Tomas P. McFie DC PhD

Tom McFie is the founder of McFie Insurance and co-host of the WealthTalks podcast which helps people keep more of the money they make, so they can have financial peace of mind. He has reviewed 1000s of whole life insurance policies and has practiced the Infinite Banking Concept for nearly 20 years, making him one of the foremost experts on achieving financial peace of mind. His latest book, A Biblical Guide to Personal Finance, can be purchased here.